Are Moving Expenses Tax Deductible?

Moving soon? Get organized with our free moving checklist.

Relocating often comes with stress and anxiety, not to mention the financial strain associated with the entire moving process. If you’re moving on your own, you’ll have to budget for packing materials, a moving vehicle, mileage, and insurance in case anything gets lost or damaged on the way.

In terms of cost, relocating can be expensive. If you’re moving in 2022, you may be wondering whether you can deduct any of your moving expenses from your income taxes.

Well, the latest tax overhaul did away with moving expenses tax deductions for most people. However, there are still ways you can save on your taxes after you relocate and this guide will show you how.

Are moving expenses tax deductible under the tax acts in 2022?

Until recently, moving for a new job or looking for work in another city was a little less expensive thanks to the Federal Moving Expense tax deduction. However, the Tax Cuts and Job Act (TCJA) passed in 2017 removed the moving expenses tax deduction for most taxpayers.

This means that at the beginning of 2018, the deduction for job-related moving expenses was suspended until 2025 unless you’re an active military member or their dependent or spouse. That said, a couple of states, including New York and California, still allow moving expense deductions on state tax returns.

It’s worth noting that the suspension of this provision is temporary, which means it may return later if Congress decides to allow the suspension to expire.

Exceptions: active military member

As mentioned previously, you can claim moving expenses on your federal tax return this year if you are an active military member. Specifically, you can claim moving expense deductions if you fall under any these categories:

- You’re an active-duty military member and moved because of a permanent change of station. This includes a move from one job to another, a move from home to your first job of active duty, and a move from your last job to your home base within a year after your active duty is complete.

- A spouse or dependent of a person that meets the qualifications above.

- A dependent or spouse of military personnel that died, deserted, or is imprisoned.

The deductible expenses include the cost of packing and transporting household goods and travel expenses, in-transit storage, moving pets, lodging and airfare costs during the transportation process, as well as a few other unique costs. The cost of moving privately and disconnecting utilities is also deductible.

Other moving expenses are not counted as deductibles including costs related to selling and buying houses, mortgage penalties, real estate taxes, and more. Indirect costs of moving such as house-hunting trips, meals, attorney’s fees, and temporary living expenses can’t be deducted either.

Military members and their families will need to record deductible expenses on Form 3903 and then follow the guidelines to carry the total deduction to Form 1040. IRS Publication 3 outlines the tax deduction for active military members and the process of claiming it. In case you relocated in 2018 or later, the IRS offers a short guideline tool to help you determine if your expenses are deductible or not.

If you are a military member, what are the qualifications to deduct moving expenses?

If you qualify for a federal moving expense deduction, here are some keys thing to keep in mind:

Distance test: Your new job location should be at least 50 miles further away from your old workplace. For example, if your previous job was 10 miles from your old location, your new job should be 60 miles from your old home to qualify.

Time test: To meet the time test, you should work as a full-time employee in your new job location for at least 39 weeks in the course of the first 12 months after you arrive in the designated area.

For self-employed individuals, they should work for at least 78 weeks during the 24 months following your relocation.

The only exception to the time test is if any of the following apply:

- In case of a transfer for the benefit of your employer.

- Your jobs come to a halt due to disability.

- Death.

- You’re a member of the military and the move is a result of a permanent change of station.

- Discharged or laid off for another reason other than willful misconduct.

Are employer-reimbursed expenses taxable?

In case your employer or company has given you a moving allowance, and you’re a non-military taxpayer, the reimbursement is now included in your taxable income on your Federal income tax as part of your W-2 form.

Employers know this, and they may even offer a larger relocation allowance to cater to the tax implications. If you’re negotiating for a new job, ensure you ask for an additional allowance to account for the tax bill. Keep all the bills, receipts, and mileage logs related to this move including your W-2 Form and the statement of reimbursement from your employer.

For example, if you’re an employee in the state of New York applying for reimbursement, the guidelines and instructions you need to provide to your employer included the bill of landing from your mover or receipts from a rental moving truck.

How to deduct charitable donations

The biggest challenge when moving out is downsizing. Often, we have valuable items to donate such as clothing, furniture, and other items before moving. The IRS has rules and guidelines on what can be deducted as charitable donations. That said, there are also tax benefits. For example, you can claim a deduction on your charitable donations as long as you keep your receipt.

A good rule of thumb is to ensure you donate only the items in good condition that would fetch a fair price. To deduct items such as household goods, clothing, used furniture, books, and shoes, the IRS requires that you price the items at the time of donation. Major agencies such as the Goodwill Value Guide and the Salvation Army Donation Value Guide offer valuable insights that are quite helpful. Before making a decision, ensure you consider factors such as the original retail price including the age and condition of the item.

Check your eligibility

No matter the distance, moving can be expensive. While the Federal Moving Expense deduction may no longer apply (at least for now), it’s important to research and know which state moving expense deduction you may still be eligible for. Talk with your employer about the benefits you can get, and take advantage of any plan that may help you cut costs.

Ready to make the move? Take a look at our ultimate moving checklist

Moving soon? Get organized with our free moving checklist.

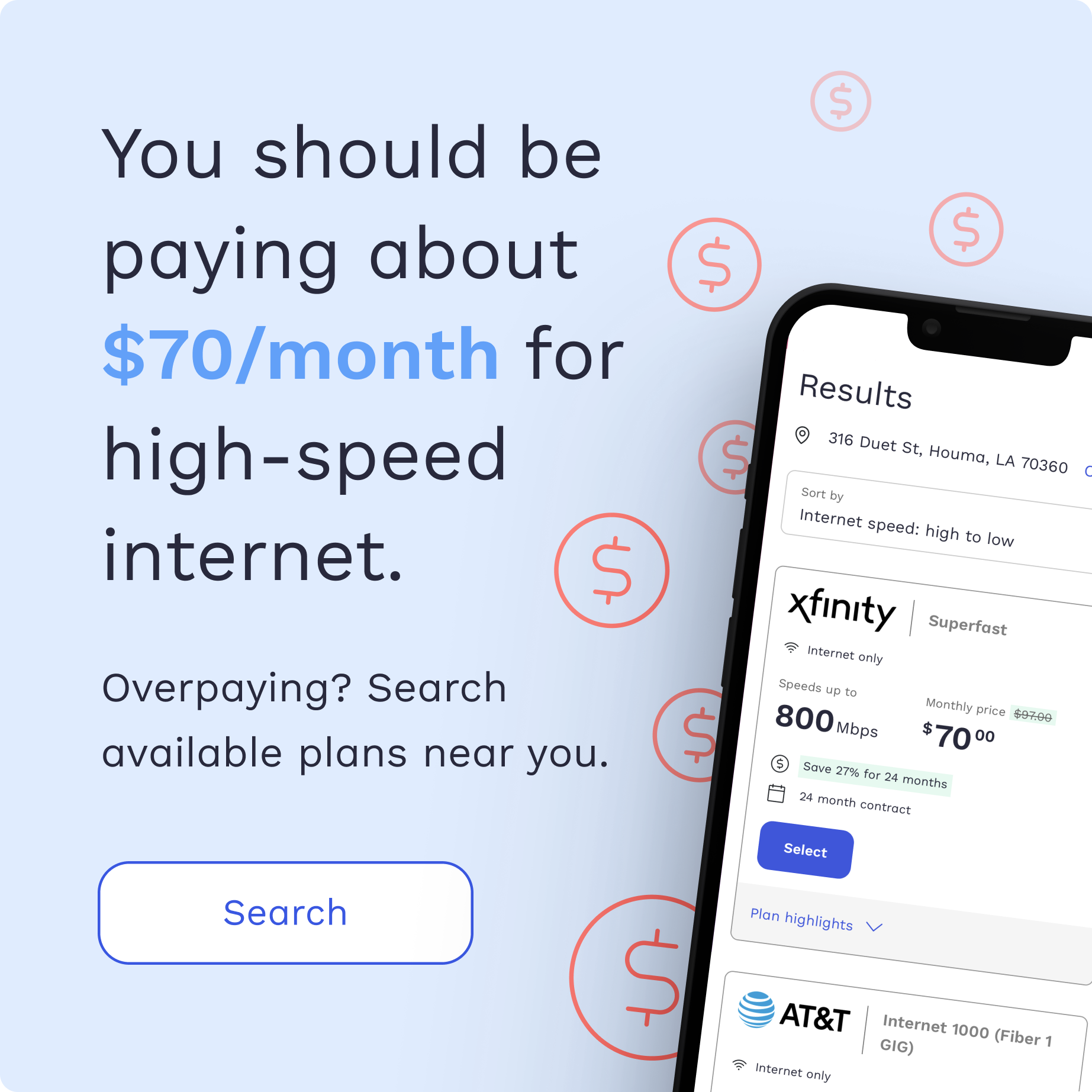

Internet and TV tips

Switching providers and don’t know where to start? We can help.